Luck v/s Skill in investing

Candid view from a personal experience, how being happy with 70% gain led to missing a 540% upside !

Dear Reader,

Have you ever been lucky in investing?

I have. Maybe , thanks to pure luck. ( or was it unlucky over the long term?)

Let me take you back to 2017, the beginning of my actual journey as a investor in direct equities. I along with a close friend stumbled upon this pharma company called Divis Labs .

The company had taken a beating in the stock market on account of USFDA notice. And given my superficial understanding of the pharma space, I had assumed that these notices are a usual practice which cause a temporary setback to the stock price, and once the company rectifies / acts on that notice, the stock price bounces back.

Voila! We had found the perfect money making trick!

Now, back to action.

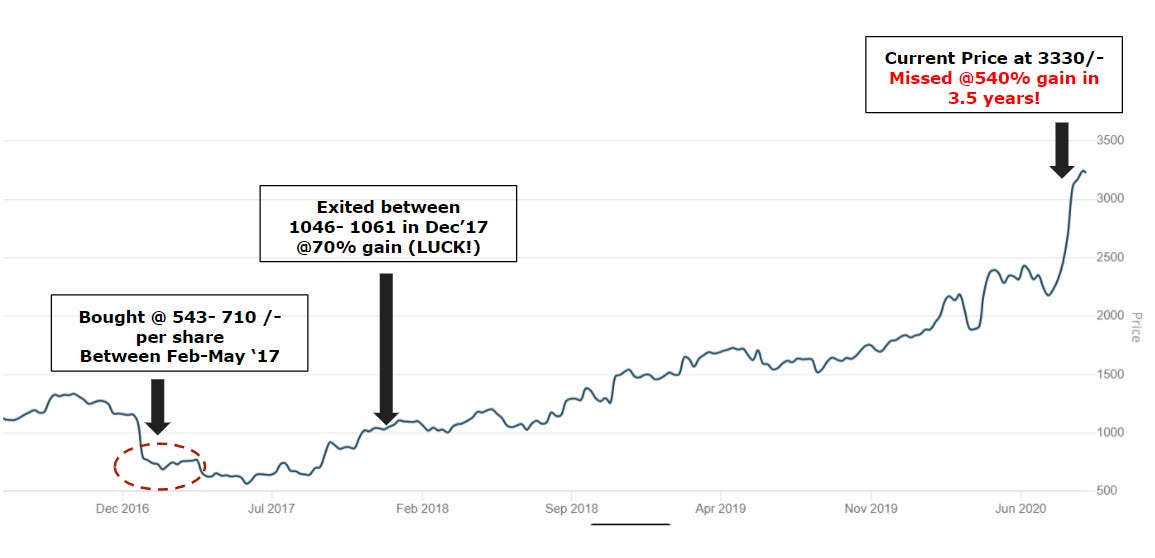

So in December 2016, Divi’s got served a USDFA notice which sent its stock price tanking from 1160/- odd levels in November’16 to 700-750/- levels in early Jan- Feb’2017 .

Enter the hero of our story i.e. Me !

Investment thesis then: ( I still laugh at myself for such naivety! Please excuse.)

Company seemed good with numbers with good sales, margins and low debt on balance sheet

This USFDA notices seems like a recurring thing to impact pharma stocks which usually bounce back (aha!)

This seems like a really good opportunity to double my investment in a short time (yeah right!)

Note : I DID NOT DO the minimum required company research by going through annual reports, con call transcripts, credit rating reports then. Thank God that it gave me an opportunity to compound wisdom! Hence this newsletter!

So I started investing from Feb 2017 on wards buying all the way from 710/- odd levels to 630/- in April 2017.

The stock price fell even more during May 2017 to 540 /- levels and I bought even more! My average cost of acquisition during this whole 4 month period was 614/-

(I have since then been more aggressive averaging down on businesses I like, but of course post compounding wisdom these 3 years!)

Now begins the wait and watch.

Pretty soon , as per our awesome investment thesis, the company addressed the issues raised by USFDA and the stock price bounced back to 1,050/- odd levels.

So, given that I was proven right in the investment thesis, I went ahead and exited the stock , netting a cool ~70% gain in 10 months!

Such a great investor. Slow Claps!

This is where the line between luck and skill gets drawn. I was extremely lucky to exit a stock despite having no basic understanding of the company or the business it operated in.

In fact, this is not called luck, its gambling when you come to think of it.

“Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.”

-Paul Samuelson

Post many such good and bad experiences like this, I stumbled upon the legend who we all revere - Warren Buffet.

I perused through all the annual shareholder letters, listened to all the recordings of the Berkshire Annual meetings, discovered many more investing legends on the way like Charlie Munger, Howard Marks, Peter Lynch, Joel Greenbalt and many many more.

This journey of studying the experiences of legends vicariously has helped me become a better investor . (Hoping to beat the index over the long term - only time will tell if I was smart enough!)

Wait, the story hasn’t ended.

Guess what’s the stock price of Divis today , in September 2020, almost 3 years after I exited the stock?

3,300 !

Yes, nearly 5.5 times at the price I exited in December 2017!

My story in a embarrassing chart below:

This is what happens when a so called ‘investor’ doesn’t know what he is doing with his/her hard earned capital.

Dear Reader, I hope you are not making the same mistake as I did 3 years back. Don’t invest based on borrowed conviction. Please do your own analysis on the business before you decide to invest.

Always remember the quote below:

The stock market is a device for transferring money from the impatient to the patient

Warren Buffett

If you understand and like a business, one had to be patient with the results, and not jump with the first sign of profit or first sign of trouble. Your CAPITAL needs to be PATIENT ! ( Here are some thoughts shared on this earlier)

Keep compounding your wisdom everyday!

Note: Attaching ‘superficial’ to understanding of the pharma space was an understatement then and now also. If you want to build a deeper understanding, please read up / follow Sajal on Twitter - more famous as Unseen value.

NOTE: Please consult your financial advisor for advice before investing in any financial product. Please also note that I am not a SEBI registered investment advisor, these articles are for learning purpose only and should not be considered as investment advice. I don’t have any position in the stocks discussed in this article.