Gold Rush | Quest for the precious metal

Primer to help one understand the market of the yellow metal given the recent buzz

Dear Reader,

Thanks for opening this post.

Commodities such as gold and silver have a world market that transcends national borders, politics, religions, and race. A person may not like someone else’s religion, but he’ll accept his gold.

-Robert Kiyosaki

Today we will learn more about Gold - given its recent buzz and sharp rally in gold prices.

This puzzling rally got even more exacerbated when news arrived that Berkshire had invested in Barrick’s , a gold mining company recently in the 2nd quarter of 2020.

While its possible that Buffet has not made this investment himself , even though he has dealt with investing in commodities earlier - he had bought 3,200 tons of silver in 1997 during its lows which helped generate 97 million $ in pre-tax returns for Berkshire.

Note that it took Buffett 30 years of tracking the metal in order to make his move - highlighting the importance of patience & building a variant perception. Do refer to our earlier letters for more thoughts on the same.

Source: 1997 Berkshire Hathaway letter to shareholders

So lets get started!

Gold derives its name from Latin word - Aurum which is also its chemical symbol Au. Throughout history , men and women have coveted the possession of the yellow metal , seeking riches and glory. The artisans of ancient civilizations have used gold in decorating ornaments and religious structures , and gold objects made more than 5,000 years ago have been found in Egypt.

While we all know about the jewellery use case for the yellow metal, gold also has multiple uses like in electronics (given its high conducting abilities), mobile phones, dentistry , aerospace among host of other use cases.

Did you know that ~26,000 mobile phones would contain gold of 1 kg? ( Assuming average weight of phone being 150 gms, for reference - Iphone 11 weighs 194 gms)

“We only need 4 tonnes of used mobile phones instead of 200 tonnes of ore to produce a goldbar of 1 kg”

Umicore- leading global materials technology and recycling company

So how much gold has been mined till date?

According to the World Gold Council, around 197,576 tonnes of gold has been mined till End of 2019, of which around two-thirds has been mined since 1950. If placed side to side, all this gold will result in a cube with a side only 21 meters!

Diagram and data from World Gold Council website

Below is the split of the total above-ground stocks (end-2019): 197,576 tonnes

Jewellery: 92,947 tonnes, 47.0%

Private investment: 42,619 tonnes, 21.6%

Official Holdings: 33,919 tonnes, 17.2%

Other: 28,090 tonnes, 14.2%

Below ground reserves: 54,000 tonnes

According to data from United States Geological Survey website, nearly 3,300 tonnes of gold is mined every year with the major producing countries being China (+400 tonnes), Australia & Russia (300+ tonnes) and USA at ~200 tonnes. The maximum reserves are available in Australia, Russia, USA (3000+ tonnes).

Source: USGS Annual Gold Report 2020

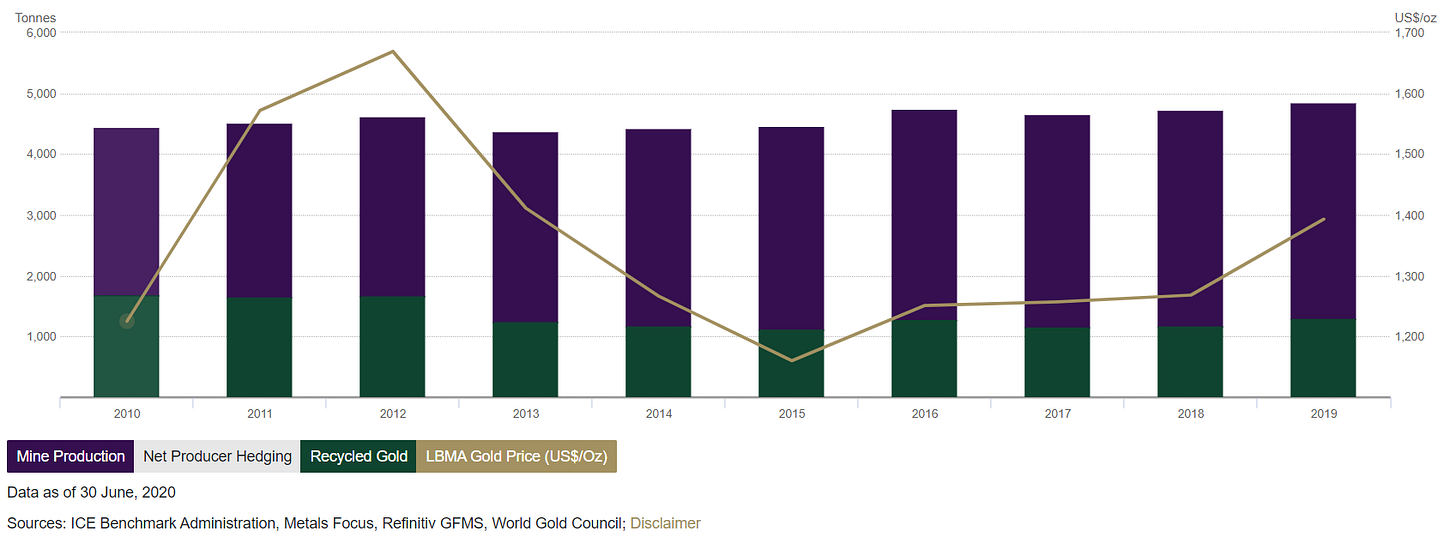

In terms of the supply of the gold of the market, nearly 27% of the gold produced annually is from recycling and the annual mine production has been in the range of 3300-3500 tonnes annually.

Given the above information, how has the price of Gold fared historically?

Gold price $ / oz from LBMA website from 1970 to 2020

As is evident from the chart above, the price of gold oscillated sideways (27 years between 1980 to 2007 & 9 years between 2011 to 2020! ) before moving up sharply in times of crisis - in 1980 / 2009-11. We see a similar uptrend underway during the current Covid incuded economic crisis as well.

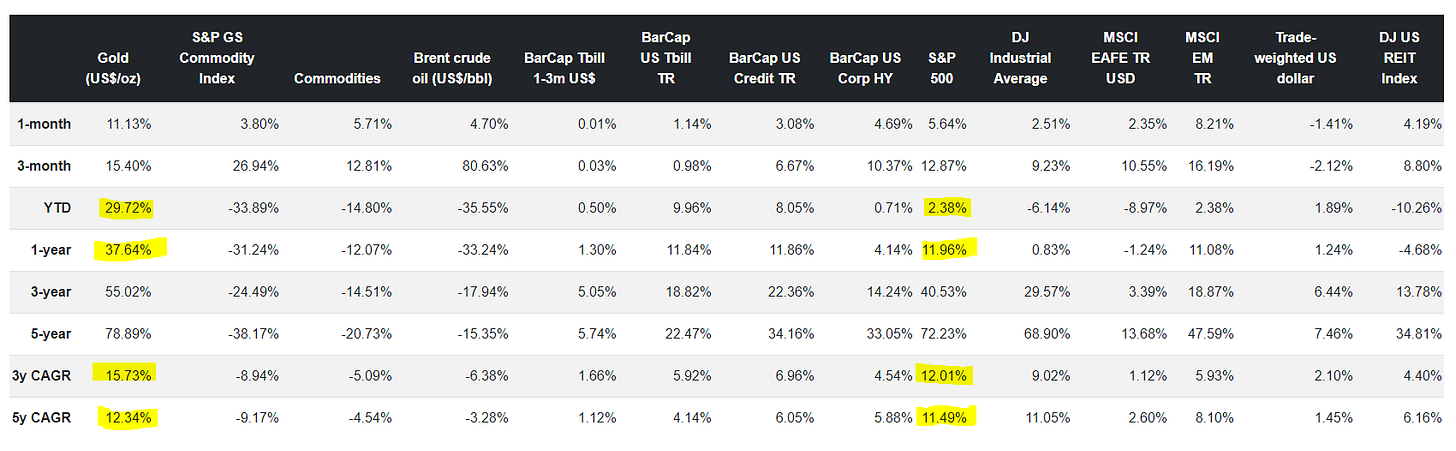

Given the sharp run up in the gold price and depressed stock prices in the broader markets due to CoVid, no wonder gold is the among the best performing asset class over the last 5 years.

Source: Gold returns on Gold Data hub, data as of 31st July 2020

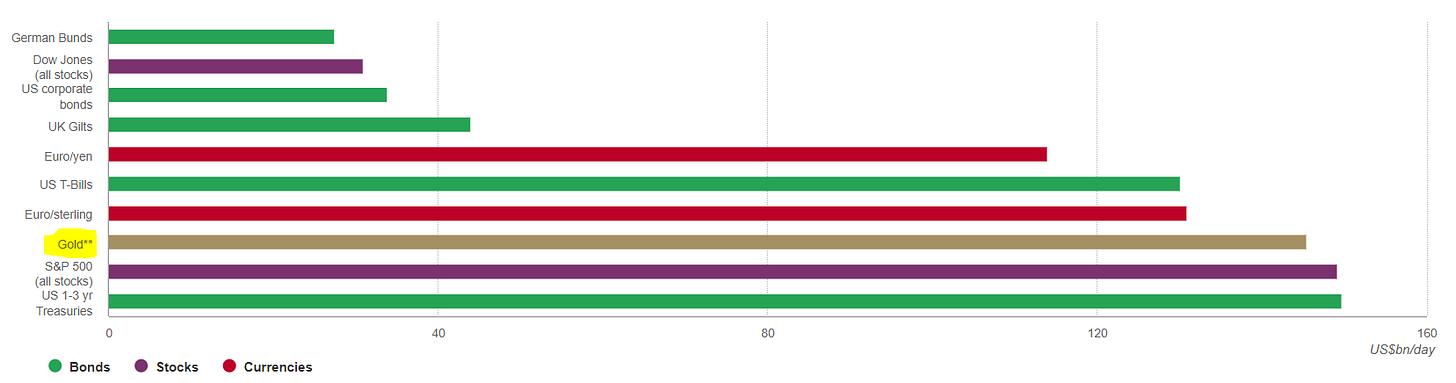

Even in terms of liquidity, gold is the third most heavily traded instrument in the US market (see below). The global market liquidity (average daily volumes) is 187 Bn $ in 2020 up from nearly 145 Bn $ in 2019.

Source:Trading volumes

How has the demand for gold fared in the recent years?

The global demand for jewellery has been fairly constant between 2,000-2,200 tonnes for the last 10 years, currently the investment led demand along with price momentum seems to mitigate the demand weakness in consumption segments .

The jewellery, bar and coin and technology used to drive nearly 86% of total gold demand annually for the last 10 years. However ,in Q2-2020, only 32% of gold demand came from jewellery, bar and coin and technology, with the remainder coming from investments – like gold ETFs – and central banks.

More over, the annual demand from central banks has risen sharply from 80 tonnes in 2010 to 660+ tonnes in 2019 .

Central banks have been loading up their gold investments - total holdings by central banks around the world is nearly 35,000 tonnes in Q1-2020!

In terms of country wise central banks, USA has the highest holding at 8,133 tonnes (nearly 79% of total central bank reserves!), compared to India at 657 tonnes (7.5% of total central bank reserves)

Source: World Official Gold holdings, International Financial statistics Aug’2020

In India, even the RBI has been shoring up gold reserves over the last 20 years as depicted below:

Source: India Data book from India Data Hub

Central banks usually buy gold in event of financial crisis as a hedge for protecting national assets in times of crisis. In addition, the recent negative interest rates have also bolstered the investment push towards gold . Recent reports indicate nearly 15 trillion $ of global debt having negative yield.

The sharp rally in prices has also led to increased inflows towards gold linked ETF’s (Exchange traded funds) - the total global AUM was ~541 tonnes in 2016 which has risen to ~900 tonnes in 2020!

We see the ETF inflow has been increasing across all the countries in 2020

YTD data as of 14th August 2020

Comments:

The recent run up in the gold prices has been exacerbated by the increased inflows towards ETF’s and shoring up of the gold reserves by central banks

Given that gold prices usually move sideways for a long period of time post a sharp rally (27 years & 9 years!), one can’t be sure if the current rally will sustain or not.

However, given the low/negative yields being offered by safer debt/government bonds , gloomy market scenario and pumping of money by central banks, there might be increased investment flows towards precious metals like gold /silver.

If you liked this post, please feel free to share!

Disclaimer: Please consult your financial advisor for advice before investing in any financial product. Please also note that I am not a SEBI registered investment advisor, these articles are for learning purpose only and should not be considered as investment advice.